More Vancouver homes occupied, initial 2019 Empty Homes Tax statistics show

Almost 15% fewer properties declared vacant since last year, 30% since launch

The Empty Homes Tax is working. Our second set of year-over-year data clearly shows we're returning more empty homes to the rental market.

Mayor Kennedy Stewart

The number of residential properties in Vancouver declared vacant in 2019 under the Empty Homes Tax program has gone down 14.6% from 2018 and 30% in total from the first year of the program (2017), with the continued trend of previously empty homes being returned to the rental market.

“The Empty Homes Tax is working. Our second set of year-over-year data clearly shows we're returning more empty homes to the rental market,” said Mayor Kennedy Stewart.

“While we're moving in the right direction, I want to see even more empty homes rented out and that's why we're increasing the tax to 1.2% for the 2020 tax year. Homes are for people, not speculation, and I hope this higher penalty will provide even more of an incentive for owners of empty properties to make sure they are occupied,” Stewart added.

Properties declared vacant

As of the February 4, 2020 declaration deadline, 787 properties were declared vacant in 2019, compared to 922 at the same point in 2018, and 1,131 in 2017. Again this year, 97% of residential property owners made their property status declaration by the deadline.

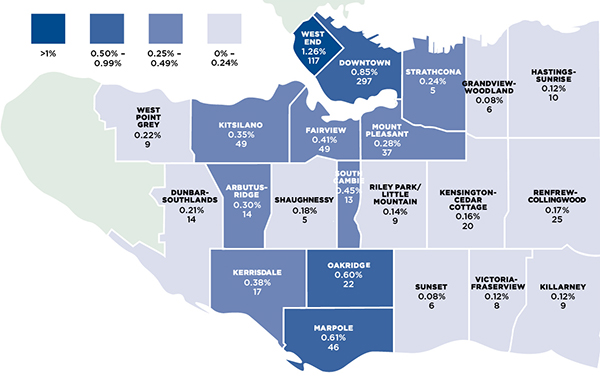

The geographic distribution of vacant properties in Vancouver in 2019 based on declarations to date is similar to last year, with the largest concentration in the West End and downtown areas. The total number of residential properties in the city overall increased 1.6% year over year; mostly attributed to a 3% increase in the number of condominium units.

Properties declared vacant by neighbourhood

Properties that were declared vacant or deemed vacant by the City (if a declaration was not received by the deadline), will be issued a bill for 1% of the property’s 2019 assessed taxable value. Empty Homes Tax payments are due by April 16, 2020.

Late declarations

Starting February 7, property owners who missed the deadline can still make a late declaration after they pay a $250 late fee (or dispute the bylaw fine).

The 2019 property status statistics (and the associated revenue) will change as the City’s audit program continues, late declarations are made, and property owner appeals and complaints are received and resolved.

Speculation and Vacancy Tax

The City of Vancouver’s Empty Homes Tax is separate from the provincial government’s Speculation and Vacancy Tax; inquiries regarding the province’s tax may be directed to spectaxinfo@gov.bc.ca or by calling 1-833-554-2323.

The Empty Homes Tax is one of the tools being used to address the Vancouver’s rental housing crisis. Net revenues from the tax are being reinvested into affordable housing initiatives in the city.